Step 1: A Guide to Home Weatherization

- Oct 11, 2022

- 7 min read

Updated: Nov 21, 2022

By Mark Adams

This is the first in a series of blog posts that will show homeowners the stairway to Net Zero housing. Net Zero houses produce more energy than they consume. Most homes, regardless of their age, can be upgraded to become Net Zero. But even taking just a few of these steps will enable homeowners to reduce their carbon output as well as save on their monthly utility bills.

Upcoming blogs will focus on available technologies for hot water heating, major appliances, home heating/cooling, and solar installation plus the rebates and tax incentives available to homeowners that invest in energy efficiency. But we’re going to start with the benefits of weatherizing your home. Why? Because finding and addressing areas of insufficient insulation is the most cost-effective way to reduce a home’s carbon output. It will also make your house more comfortable by reducing temperature fluctuations. The benefits that come from energy efficient heating and cooling systems are reduced if the heated or cooled air easily escapes through poorly insulated ceilings, walls, or windows.

In addition to general insulation, air sealing involves sealing any gaps in the building envelope penetrations and construction joints. Some types of insulation also air seal those gaps, others do not. Air sealing can make a significant difference in the “draftiness” of a house, where insulation alone may not seal in heated or conditioned air.

In home assessment

Prior to upgrading your home’s insulation, you should have a certified professional evaluate your home for energy-saving opportunities and provide a custom home energy report outlining your recommended upgrades and any incentives you may qualify for.

The Marblehead Light Department offers a Free Home Energy Audit Program. Click on the following link to find the brochure that tells you how to schedule an audit: https://marbleheadelectric.com/rebates-incentives.html.

National Grid customers for natural gas deliveries are eligible for the energy audit program that is administered by Mass Save. More details can be found here: https://www.masssave.com/en/saving/energy-assessments.

Eligibility for the NetZero rebates that are listed below require homeowners to have first had their house inspected by one of their auditors.

What is an R-value?

The R-value is the measurement of a material’s resistance to the flow of heat. The higher the R-value, the better the material works as an insulator.

For the weather in our region, Energy Star recommends the following R-values for new insulation:

Uninsulated attic – R49 to R60

Attic with up to 4 inches of existing insulation – R38 to R49 (for the added insulation)

Flooring – R25 to R30

Uninsulated wood-frame wall – Add R5 to R6 insulative wall sheathing beneath new siding

Insulated wood-frame wall – Add R5 insulative wall sheathing beneath new siding

The US Department of Energy warns homeowners that just 1 in 5 homes constructed prior to 1980 are sufficiently insulated. While homes constructed today are required to meet their region’s current R-Value standards, this requirement was generally not included in building codes prior to the mid-1970s.

Insulation options

Blanket insulation is relatively inexpensive and is the type of wall and ceiling insulation that is most commonly installed. Blanket insulation is typically made from fiberglass, but it can also be made from other synthetic or natural materials such as sheep’s wool. This insulation comes in long rolls or pre-cut batts that fit between the standard spacing of wall studs or attic trusses. Deeper size framing can hold thicker blankets which have higher R values. Due to sloppy installation, small voids can occur that lead to air leaks and poor performance. Older homes were frequently built with thinner blankets/lower R values than required by building codes today.

Loose-fill and blown in insulation is a good choice for adding to existing insulation in an unfinished attic or blown into walls without removing interior wallboard or exterior sheathing and siding. This is one of the most practical solutions for insulating old houses. It can settle well into cracks; however, it also settles so that the tops of stud bays originally filled may develop voids over time. Other obstructions, such as electrical outlet boxes, can block areas from being filled.

Spray foam insulation can help make a house airtight; it works as a vapor barrier, and it adds significant insulating properties. There are two types of foam-in-place insulation: closed-cell and open-cell. Budget and use will determine which is a better choice. While closed-cell foam has a greater R-value and provides stronger resistance against moisture and air leakage, the material is also much denser and is more expensive. Open-cell foam is lighter and less expensive but should not be used below ground level where it could absorb water. Today, most foaming agents don't use CFCs or HCFCs, however, air quality and end-of-life disposal of the product and anything it touches are still important considerations. Spray foam can be applied into enclosed walls or between open attic joists. Applications can also be made in basements to insulate underneath the lower-level floorboards. Also, spray foam is available in small cans to seal penetrations in a home’s envelope made for plumbing, sewer, and electrical service lines, as well as between joints in construction such as wall/floor joints at rim joists, and around window and door perimeters.

Rigid foam boards are an easy way to add insulation to existing assemblies. They can be used almost anywhere and comes in a variety of thicknesses and facings. However, foam manufacturing uses CFCs and other toxins that can result in out-gassing. Therefore, when used inside homes, a waiting period may be desired before occupying this part of the home. Rigid foam boards need to be covered by gypsum wallboards or other interior finished surfaces. These boards are most often used as an exterior wrap that lays between the outer wall studs and the siding. They provide very good thermal resistance (up to 2 times greater than most other insulating materials of the same thickness) and reduce heat conduction through structural elements, such as studs.

Rigid fibre boards are an alternative to rigid foam boards. They are largely comprised of rocks, can have high recycled content, and contains no blowing agents or CFCs. They’re durable and versatile; they’re also fire resistant, non-combustible, sound-absorbent, and water repellant. Unlike rigid foam, rigid fibre boards don’t allow bugs or pests to tunnel through.

Additional weatherization opportunities

Doors – replacing drafty doors will help improve a home’s insulation. This can be done by installing new foam core doors that are protected by glass storm doors. Even adding or replacing the door sweep, threshold gasket, and/or the frame weatherstripping can have an immediate impact.

Windows – older windows can also lead to excessive heat loss. This is particularly true of single pane windows or windows with broken seals. These should be replaced.

Ducts – leaks in the ducts that move heated or cooled air can lose up to 30% of the energy produced. A professional should be hired every few years to inspect and repair ducts for any leaks.

Financial rebates and tax credits

There are incentives offered by the federal government and local utilities to help homeowners pay most or even all of the cost of weatherization upgrades. Make sure you discuss these available incentives when you get your in-house energy audit.

Federal programs

The Inflation Reduction Act introduced two incentives for insulation upgrades that are installed on or after Jan 1, 2023. Note, however, that the rules for implementing the first program, the HOMES rebates, are not expected from the Department of Energy until the spring of 2023. Therefore, these contractor rebates will not be available until that time.

The HOMES rebate program provides upfront discounts of up to $1600 for new insulation. Lower income taxpayers who earn less than 80% of their Area Median Income can get a rebate of 100% of their insulation costs up to the $1600 limit. Moderate income taxpayers who earn between 80% and 150% of their Area Median Income can get a rebate of 50% of their insulation costs up to the same $1600 limit. The HOMES rebates will be given to consumers at the point of sale.

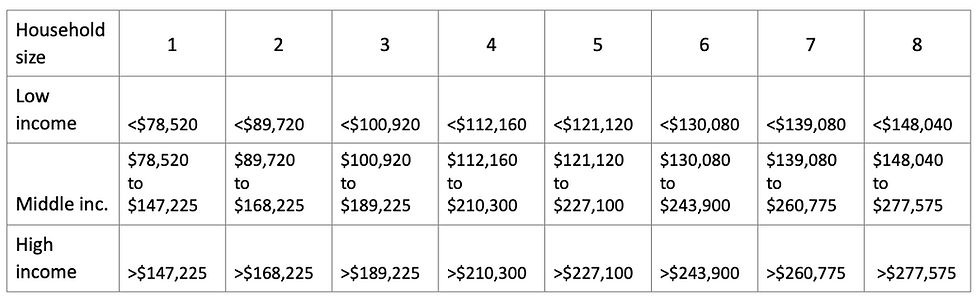

The current Area Media Income for Marblehead can be found in the following table*:

*The table above is for the 2022 tax year. This table will be updated in 2023.

The High-Efficiency Electric Home Rebate Act (HEEHRA) provides for a tax credit equal to 30% of the cost of insulation with a limit of $1200 per year. While less generous than the HOMES rebate program, the HEEHRA credit has no income limits so homeowners who fail to qualify for the HOMES rebate may be eligible for this tax credit. Also, low- and middle-income taxpayers who qualify for the HOMES rebate, can still get the HEEHRA 30% tax credit for the remainder of their payment balance.

Consult your tax advisor about how you can take advantage of these program to offset the cost of weatherization.

For new Energy Star approved doors, there is a federal tax credit of $250 per door with a limit of 2 doors, or $500, per year. And the federal tax credit for the installation of Energy Star windows is $600 per year.

Utility programs

The NextZero program from the Marblehead Light Dept provides an additional 50% rebate for insulation projects with a $500 annual limit. The program also offers up to a $500 rebate for the cost of duct sealing. These rebates require the completion of a Home Energy Audit prior to installation. You can schedule your audit by calling 888-333-7525. The Home Energy Efficiency Rebate Form can be found here: https://marbleheadelectric.com/rebates-incentives.html.

Homeowners who are customers of National Grid for natural gas deliveries would do better by applying for rebates through the Mass Save program. Mass Save will rebate between 75 and 100% of the cost of installing insulation upgrades. There are no income limits for participation. Mass Save customers can also receive a rebate of $75 per window for the installation of new Energy Star windows. The online site to apply for a MassSave rebate is found here: https://frontdoor.portal.poweredbyefi.org/initiative/marebates.

Mass Save also offers 0% interest loans of up to $25,000 for the out-of-pocket costs of qualified energy efficient home improvements.

Additional info and applications for the Mass Save rebates can be found here: https://www.masssave.com/en/saving/residential-rebates.

Here’s an example, a family of 4 with moderate income (taxable income less than $210,000) has insulation installed in their house in Jan 2023. The contractor price is $4,000. The price gets an upfront discount of $1,600 from IRS HOMES program resulting in a net price paid to the contractor of $2,400. The homeowners can take another $720 tax credit when they file their federal income taxes. Since they are customers of Marblehead Light, they can also take another $500 rebate which brings their net cost down from $4,000 to be $2,380. If they’ve also been getting gas from National Grid, they are eligible for a rebate equal to their remaining balance so they will pay $0 for the insulation project.

Comments